Deductions

D1 – Work Related Car Expenses

Work-related car expenses are expenses you incurred as an employee for a car you:

- owned

- leased, or

- hired under a hire-purchase agreement

What can you claim?

You can claim car expenses you incurred for work-related purposes in each financial year. You can also claim the cost of using your car to travel directly between two separate places of employment, for example, when you have a second job.

You cannot claim for the normal trip between home and work, unless:

- you use your car to carry bulky tools or equipment (such as an extension ladder or cello) which you use for work and cannot leave at work

- your home is a base for employment (you start work at home and travelled to a workplace to continue work for the same employer), or

- you have shifting places of employment (you regularly work at more than one place each day).

You must claim at this item any work-related car expenses incurred in earning income shown on a PAYG payment summary – foreign employment.

Parking and Tolls

You can only claim parking that is specifically work related. This does not include travel to and from work to home unless carrying heavy tools. You must have receipts/ invoices as proof or a proper vehicle log.

Do you have work Related Travel Expenses?

This question is about travel expenses you incur that are directly related to your work as an employee. They include:

- public transport, including air travel and taxi fares

- bridge and road tolls, parking fees and short-term car hire

- meal, accommodation and incidental expenses you incur while away overnight for work

- expenses for motorcycles and vehicles with a carrying capacity of one tonne or more, or nine or more passengers, such as utility trucks and panel vans

- actual expenses (such as any petrol, oil and repair costs) you incur to travel in a car that is owned or leased by someone else.

Special Note

If your employer provided a car for you or your relatives’ exclusive use and you were entitled to use it for non-work purposes, you cannot claim a deduction for running costs (petrol, repairs). However, you can claim expenses such as parking and bridge and road tolls for work-related use.

Reasonable allowance amounts

If your travel allowance was not shown on your PAYG payment summary or myGov income statement and was equal to or less than the reasonable allowance amount for your circumstances, you do not have to include the allowance at item 2 provided that you have fully spent it on deductible work-related travel expenses and you do not claim a deduction for these expenses.

Answering this question

You must have written evidence for the whole of your claim. If you wish to claim meal, accommodation and incidental expenses you incurred while away overnight for work, use the table on page 75 to determine what evidence you need.

You must claim at this item any work-related travel expenses incurred in earning income shown on a PAYG payment summary – foreign employment.

Do you have Work Related Uniform, Occupation Specific or Protective Clothing?

You can claim expenses you incurred as an employee for work-related:

- protective clothing

- uniforms

- occupation-specific clothing, and

- laundering and dry-cleaning of clothing listed above

You can claim the cost of a work uniform that is distinctive (such as one that has your employer’s logo permanently attached to it) and it must be either:

- a non-compulsory uniform that your employer has registered with AusIndustry (check with your employer if you are not sure), or

- a compulsory uniform that can be a set of clothing or a single item that identifies you as an employee of an organisation. There must be a strictly enforced policy making it compulsory to wear that clothing at work. Items may include shoes, stockings, socks and jumpers where they are an essential part of a distinctive compulsory uniform and the colour, style and type are specified in your employer’s policy.

You can also claim the cost of:

- occupation-specific clothing which allows people to easily recognise that occupation (such as the checked pants a chef wears when working) and which are not for everyday use

- protective clothing and footwear to protect you from the risk of illness or injury, or to prevent damage to your ordinary clothes, caused by your work or work environment. Items may include fire-resistant clothing, sun protection clothing, safety-coloured vests, non-slip nurse’s shoes, steel-capped boots, gloves, overalls, aprons, and heavy duty shirts and trousers (but not jeans). You can claim the cost of protective equipment, such as hard hats and safety glasses at item D5.

You can also claim the cost of renting, repairing and cleaning any of the above work-related clothing.

Answering this question

You will need:

- receipts, invoices or other written evidence, and

- diary records of your laundry costs if

- the amount of your laundry expenses claim is greater than $150, and

- your total claim for work-related expenses exceeds $300.

You must claim at this item any work-related clothing, laundry and dry-cleaning expenses incurred in earning income shown on a PAYG payment summary – foreign employment.

If you did washing, drying or ironing yourself, you can use a reasonable basis to calculate the amount, such as $1 per load for work-related clothing, or 50 cents per load if other laundry items were included.

Special Note

You cannot claim the cost of purchasing or cleaning plain uniforms or clothes, such as black trousers, white shirts, suits and stockings, even if your employer requires you to wear them.

D- 4 Work related self-education expenses

This question is about self-education expenses that are related to your work as an employee and which you incur when you attend a course to get a formal qualification from a school, college, university or other place of education.

To claim a deduction here, you must have met one of the following conditions when you incurred the expense:

- the course maintained or improved a skill or specific knowledge required for your work activities at that time

- you could show that the course was leading to, or was likely to lead to, increased income from your work activities at that time

- other circumstances existed which established a direct connection between the course and your work activities at that time

Examples of expenses you can claim are textbooks, stationery, student union fees, student services and amenities fees, the decline in value of your computer, and certain course fees.

You must claim at this item any self-education expenses incurred in earning income shown on a PAYG payment summary – foreign employment.

Legislation has been introduced into Parliament to prevent deductions being claimed against government assistance payments, like Youth Allowance, Austudy and ABSTUDY, from 1 July 2021. This includes deductions for self-education expenses. At the time of printing the changes had not become law. For more information on the progress of the legislation, go to https://www.ato.gov.au/Individuals/Tax-return/2021/Tax-return/Deduction-questions-D1-D10/D4-Work-related-self-education-expenses-2021/ then ‘How to claim’ and read ‘Claims for 2021 and later years’.

Special Note

You cannot claim a deduction for self-education expenses for a course that:

- relates only in a general way to your current employment or profession, or

- will enable you to get new employment

D5 – Other Work Related Expenses

Other work-related expenses are expenses you incurred as an employee and have not already claimed anywhere else on your tax return. These include:

- union fees and subscriptions to trade, business or professional associations

- certain overtime meal expenses

- professional seminars, courses, conferences and workshops

- reference books, technical journals and trade magazines

- safety items such as hard hats, safety glasses and sunscreens

- the work-related proportion of some computer, phone and home office expenses

- tools and equipment and professional libraries (you may be able to claim an immediate deduction for the full cost of depreciating assets costing $300 or less; for more information see the Guide to depreciating assets 2021.)

You can claim overtime meal expenses only if they were paid under an industrial law, award or agreement and you have included the amount of the overtime meals allowance as income at item 2. If your claim is more than $28.80 per meal, you must have written evidence, such as receipts or diary entries, which show the cost of the meals.

Answering this question

You may need:

- receipts, invoices or written evidence

- statements from your bank, building society or credit union

- your PAYG payment summary – individual non-business or myGov income statement.

If your total claim for all work-related expenses exceeds $300, you must have written evidence.

You must claim at this item any other work-related expenses incurred in earning income shown on a PAYG payment summary – foreign employment, provided you have not already claimed the expense anywhere else on your tax return.

Special Note

You cannot claim a deduction for certain items provided to you by your employer, or if your employer paid or reimbursed you for some or all of the cost of those items, and the item was exempt from fringe benefits tax.

D6- Low Value Pool Deduction

This question is about claiming a deduction for the decline in value of low-cost and low-value assets that you:

- used in the course of producing income you show on your tax return, and

- allocated to what is called a low-value pool.

Low-cost assets are depreciating assets that cost less than $1,000. Low-value assets are depreciating assets that are not low-cost assets but which, on 1 July 2021, had been written off to less than $1,000 under the diminishing value method.

Assets you can allocate to a low-value pool include assets you use:

- in your work as an employee, or

- to gain rental income If you claim the deduction at this item, do not claim it at items D1 to D5 and 21.

Special Note

If your low-value pool contains only assets used in business, do not show your deduction at this question. Show it at item P8 on the Business and professional items schedule for individuals 2021.

D7 – Interest Deductions

Expenses include:

- bank or other financial institution account-keeping fees for accounts held for investment purposes

- fees for investment advice relating to changes in the mix of your investments

- interest you paid on money you borrowed to purchase income-producing investments

Answering this question

You will need your bank or financial institution statements or passbooks.

Special Note

If you had a joint account or if you shared an interest-earning investment, show only your share of the joint expenses.

D8 – Dividend Deductions

Expenses include:

- fees for investment advice relating to changes in the mix of your investments

- interest paid on money borrowed to purchase shares or similar investments

- costs relating to managing your investments, such as travel and buying specialist investment journals or subscriptions.

You must also complete this item if your dividends included an amount for capital gain from a listed investment company (LIC).

Answering this question

You will need the dividend statements that you used at item 11 that show the dividends received from a LIC.

If you were an Australian resident for tax purposes when a LIC paid you a dividend and the dividend included a LIC capital gain amount, you can claim a deduction of 50% of the LIC capital gain amount. The LIC capital gain amount appears separately on your dividend statement.

Special Note

If you had joint share investments or similar shared investments, show only your share of joint expenses. If you borrowed money to purchase assets for your private use and income-producing investments, you can claim only the portion of the interest expenses relating to the income-producing investments

D9- Gifts or Donations

Did you make a gift or donation of $2 or more to an approved organisation?

Your receipt should show whether your donation is tax-deductible.

To check whether an organisation is an approved organisation, contact them or go to abn.business.gov.au

Special Note

Generally, you cannot claim a deduction for a gift or donation if you received something in return (for example, raffle tickets or dinner).

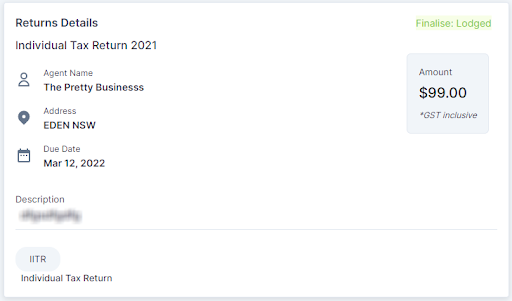

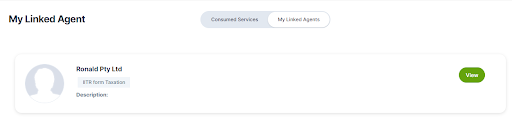

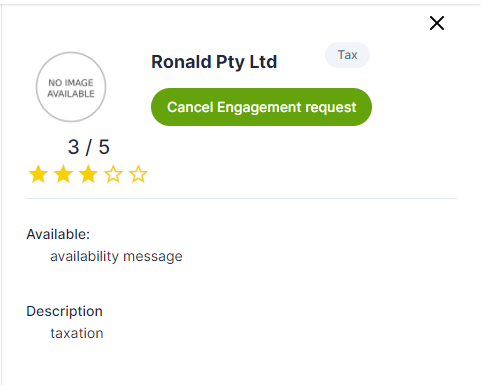

D10 – Cost of Managing tax affairs

The cost of managing your tax affairs includes

- preparing and lodging your tax return and activity statements

- fees paid to a recognised tax adviser for preparing and lodging your tax return

- travel to obtain tax advice from a recognised tax adviser

- buying tax reference material

- dealing with us about your tax affairs

- appeals made to the Administrative Appeals Tribunal or courts in relation to your tax affairs

- an interest charge we imposed on you

You can also claim any costs you incurred in complying with your legal obligations relating to another person’s tax affairs.

Special Note

You cannot claim:

- the cost of tax advice given by a person who is not a recognised tax adviser

- a deduction for tax shortfall and other penalties for failing to meet your obligations.

D11 Deductible amount of undeducted purchase price of a foreign pension or annuity

To claim this deduction you must show income from a foreign pension or annuity.

The UPP is the amount you contributed towards your pension or annuity. Only some foreign pensions and annuities have a UPP.

D12 Personal superannuation contributions

You may claim a deduction for personal contributions you made to your complying superannuation fund or RSA if:

- you gave them a valid notice to tell them how much you intend to claim as a deduction

- your fund or RSA acknowledged your notice

- either of the following applied to you

- you were fully self‑employed and not working under a contract principally for your labour

- the salary, wages and other remuneration, which you received in return for your personal labour or skills, make up less than 10% of the sum of the following:

- your reportable employer superannuation contributions (shown at item IT2)

- your total reportable fringe benefits amounts (shown at item IT1)

- your assessable income

Special Note

Generally, you cannot claim a deduction for personal superannuation contributions if:

- you made the contributions after you turned 75 years old

- you were under 18 years old on 30 June 2021 and you were not carrying on a business and did not receive remuneration for your personal labour or skills, or

- you were under 55 years old and the contribution was attributable to a capital gain to which the small business retirement exemption applied.

D13 Deduction for project pool

You may be able to claim a deduction for capital expenditure allocated to a project pool for a project you:

- operated in 2020–2021 for a taxable purpose

- carried on, or proposed to carry on, for a taxable purpose which was abandoned, sold or otherwise disposed of in 2020–2021, before or after it started to operate

Examples of this capital expenditure include:

- site preparation for depreciating assets (other than in draining swamp or low‑lying land or for clearing land for horticultural plants)

- feasibility studies or environmental assessments for the project

D14- Do you have Forestry MIS?

You can claim a deduction at this item only if the forestry manager has advised you that the FMIS satisfies the 70% direct forestry expenditure rule.

D15- Other Deductions

Expenses you may be entitled to claim

You may claim at this item:

- election expenses

- premiums you paid for insurance against the loss of your income

- foreign exchange losses

- debt deductions incurred in earning assessable income that have not been claimed elsewhere

- debt deductions incurred in earning certain foreign non‑assessable non‑exempt income

- amounts you can deduct over five years under section 40‑880 for certain business‑related capital expenditure not claimed before you stopped carrying on a business

- a deduction for the net personal services income loss of a personal services entity that related to your personal services income

- certain capital expenditure not claimed before ceasing a primary production business where a deduction can be claimed in a subsequent year or years

- losses incurred on the disposal or redemption of a traditional security; see Sale or disposal of company bonds and convertible notes in You and your shares 2021 (NAT 2632) at ato.gov.au/instructions2021

- interest incurred on money borrowed to invest under the infrastructure borrowings scheme if you intend to claim a tax offset at item T14

- small business pool deductions for depreciating assets that you cannot claim at item P8 on the Business and professional items schedule for individuals 2021 (NAT 2816) because you did not carry on a business in 2020–2021; see Concessions for small business entities (NAT 71874) at ato.gov.au/instructions2021

- self‑education expenses incurred in satisfying the study requirements of a bonded scholarship.

Debt deductions

Claim at this item ‘debt deductions’ you incurred in earning:

- assessable income you have not claimed elsewhere on your tax return, or

- certain types of foreign non‑assessable non‑exempt income that were payments out of attributed controlled foreign company income and attributed foreign investment fund income.